7 Attributes Of An Ideal Investment

In my last blog post, I discussed the pre-requisite of finding an ideal investment. Namely, you as the investor need to be ideal. What I mean is you need a sound financial education. Without the right kind of financial education, you simply cannot tell the difference between and good or bad investment. Here is a good FREE webinar to start with called, “7 Key’s to Financial Freedom”.

Here is another example. In the book, “The Richest Man in Babylon”, Arkad is learning from Algamish about how to become wealthy. Arkad had saved up some of his hard earned money and had invested it with a friend, Azmur. Azmur is a brick maker who was going on a long trip and promised to purchase rare jewels on his journey. When he returned the jewels would be sold at a higher price. Azmur and Arkad would split the profits. As you already can tell a brickmaker probably knows little to nothing about how to value jewels. Sure enough, Azmur gets swindled and Arkad loses all his investment.

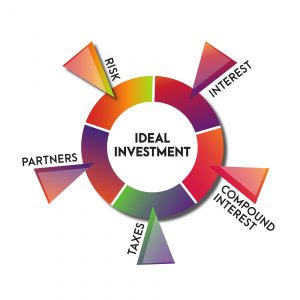

Assuming you have a decent financial IQ, whether that has come from experience by making bad investments or taking courses (like this one) or reading books here are 7 attributes of an ideal investment.

The Ideal Investment:

-

Control

The more control you have over your money the more you, not anyone else, will benefit from the money. This may surprise you, but it should not surprised you. Control of the investment or asset is the #1 attribute when determining the ideal investment. Have you ever watched the hit TV show Shark Tank? If you have not, you should watch it several times to increase your financial IQ. One thing you will notice when the entrepreneurs come before the billionaires (Sharks) begging for money is how often a 51% stake in the company is talked about. Why? CONTROL! If the Sharks can get 51% of the company they know their investment is a lot more secure and profitable. Many of the world’s wealthiest people have made their money by having a significant equity stake (control) in a profitable investment such as a business, mine, oil well etc.

-

No loss guarantees

Warren Buffet the legendary investor often referred to as the Sage of Omaha reportedly has two rules for investing. 1) Never lose money. 2) Never forget to obey rule #1. The skeptics will say there is nothing that is absolutely guaranteed except change, taxes, and death with which I agree. However, the closer an investment can come to having a guarantee that you will not lose any of your investment you are on the right track. Let’s take a look at the investment a bank makes in the mortgage on your house. Yes, the bank is investing in the mortgage. The first thing they do is investigate if you are an honest person and normally pay your debts, i.e. have a good credit score. To further protect themselves they demand that you pay at least 20% of the purchase price in cash. If you cannot the banks make you purchase mortgage insurance. Ask yourself who the insurance is for, you or the bank? How could the bank lose money on this investment? Fire, flood, tornado, hurricane? Nope, you are required to pay for insurance to guard against any loss like that, again for you or for the bank? If you think through it the bank is nearly guaranteed it will not lose money. Please be clear this example is about the investment in the mortgage, not the underlying real estate.

-

Taxes

As we have already agreed taxes are pretty close to a guarantee. Especially when you make money or your investment makes you money. It almost goes without saying that the more you can keep of your investment earnings the better. Any investment you are considering should have a provision to legally avoid as much taxation as allowed. (If you don’t know much about this I’ll speak on it more live here.) Notice I said avoid, not defer. A tax deferral, i.e. found in 401(k), 403(b), Keoh, IRAs, does not avoid paying taxes. It is just giving you a chance to pay your taxes later. To be clear with those plans and investments within those plans taxes will be paid and often at regular income rates which are often higher. When looking for an ideal investment look for something that is at least tax favored and if possible grows and transfers to heir tax-free.

-

Government imposed restrictions

Restrictions on an investment are a double-edged sword so be careful. Sometimes a great investment will be reserved by law to accredited (read educated or accomplished) investors. But beware even so-called private placement or investments for accredited investors can be riddled with fraud and deceit. Another reason to consider the restrictions is who created or dictates the restrictions? Who has the power to change the restrictions? A change in an investment for political reasons does not sound very good to me.

-

Liquidity

This one is also a double-edged sword. What good is an investment if you cannot get your money back out? What if you come across a better investment how fast can you get access to your money in another investment to go with the perceived better investment? On the other hand, the ease of getting access to your money potentially could aid you in making less than optimal investment decisions. Many great investments like many valuable things take time to mature.

-

Rate of Return

High “rates of return are deceitful sirens that sing but to lure the unwary upon the rocks of loss and remorse,” so said Arkad, the richest man in Babylon. Investments that promise high rates of return should be considered carefully. Conversely, an investment with a low rate of return should not be scorned. Make sure you consider the investment over a long period of time, say 10 to 20 years. Some investments that look terrible in the first three to five years may be one the best investments out there. (Like one of the investments I recommend to all of my clients. Learn more about it here.)

-

Flexibility

Just ask yourself a few questions; can the investment be used for more than one purpose? Can the investment be exchanged for another investment without incurring tax? Can the investment be used as collateral for cash for another investment? Why would you want to do that? Because if it is an ideal investment you will want to keep it for as long as possible. But you also need the flexibility to use some of its value to leverage into another good investment. The investment allows your money to do more than one job at a time?

Of course, there are other attributes but these 7 are the top 7. If you want to know some other questions contact me or join me for my FREE webinar.

Trackbacks & Pingbacks

[…] show that they are investing for the best interest of their clients. (To understand what makes the ideal investment click here) Once the analysis is complete then the advisor suggests a portfolio that should best represent […]

Leave a Reply

Want to join the discussion?Feel free to contribute!