Personal Savings Rate is an Indicator of National Greatness

“Our prosperity as a nation depends upon the personal financial prosperity of each of us as individuals.” Those are the opening word to the foreword of George S. Clason’s timeless classic The Richest Man in Babylon. Although they were possible written nearly a century (1926) ago they a still true and possibly even more poignant today.

Many of us who live here feel the United States the greatest country on Earth. We have the largest GDP, the strongest military, and even the biggest oil reserve deposits in the world. We are even looked up to by developed and emerging markets for guidance during times of economic instability. But how did we get here and how do we retain this station on the world? It is all a result of the environment or culture or liberty we have to determine for ourselves our own futures. That future is highly dependent of one’s ability to be prosper financially. One area we are not the best in the world? Personal Savings Rates!

Tried and true principles of the past are rapidly being forgotten. Simple things like “pay yourself first,” “delayed gratification,” “mend it up, wear it out, make do or do without.” We are a nation of me first. We are a nation of instant gratification. Part of the reason we have these vices is because of cashless ways (credit cards and mobile payment options) to pay for items we want in the moment.

According to a recent 7,000-person survey, a whopping 69% of respondents didn’t even have $1,000 in their savings account, including 34% with $0. What about people with more than $5,000 in their savings account? Well those were less than 20% of those surveyed.

I want to ask that roughly 20 percent if government will come and take some of their money to pay for all people who don’t have any money? Doesn’t that become more and more likely the more people there are with nothing saved? Are you okay with that? Would you like to keep their money within your family?

Retirement preparedness is not an entirely different story, albeit the statistics are just as grim. According to a recently released survey from Get Rich Slowly, which was commissioned by Experian, 71% of Americans said they didn’t have enough retirement savings, with more than half of those surveyed (54%) suggesting that they would never fully pay off their debts. (I ask you, why are these people not practicing the Infinite Banking Concept so they will guarantee those debts will not be passed on to their heirs? Or even better build a legacy for them?)

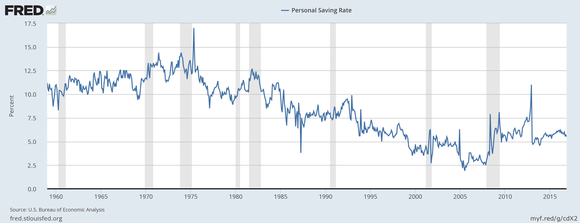

Just how bad are we in American at saving? The St. Louis Federal Reserve released the following chart showing the personal saving rate in America. In case you do not see it, this chart sums up why Americans are failing at retirement.

If we believe what George Clason said, out greatness as a nation cannot and will not continue until we as individual change the personal savings rate. I am not just saying that because it sounds good. I believe it is true.

I want your help to preserve our nation as one of the best in the world. Can you see the benefits to you if you help? How do you help? Share this article, our website, with your loved ones and those you care about.

Leave a Reply

Want to join the discussion?Feel free to contribute!